INTRODUCTION

If you are a risk management professional or business owner, you understand that organizations today face a complex risk landscape driven by technological advancements, evolving regulatory frameworks, and globalization. Developments in AI, cloud computing, and IoT have introduced significant risks, with cybercriminals using these same tools to launch more sophisticated attacks. According to the World Economic Forum’s Global Cybersecurity Outlook 2025, 72% of organizations have reported increased cyber risks.

At the same time, storing data across different jurisdictions has led to new or updated regulations such as the GDPR, the Cyber Resilience Act, among others. Combined with supply chain disruptions and geopolitical instability, these factors demand stronger risk management.

How do organizations manage risks? Organizations manage their risks in a manual or automated manner. By the term “manual,” you can imagine that this method involves using spreadsheets. One of its main advantages is that it is suitable for startups and small businesses. However, these manual methods are time-consuming, prone to human errors, and cannot be scaled once the business starts to grow. While manual risk management may work well with startups and smaller organizations, larger organizations require automated tools to manage risks effectively. This guide aims to assist decision-makers in organizations in selecting the appropriate risk management software.

WHAT IS RISK MANAGEMENT SOFTWARE?

A risk management software is a tool that includes automation features to support the following processes:

1. Risk Assessment:

– Risk identification

– Risk analysis

– Risk evaluation

2. Risk Treatment:

– Selection of risk treatment options

– Preparation and implementation of risk plans

3. Overall Risk Management

– Risk monitoring

– Risk recording

– Risk reporting

An automated tool, unlike manual methods of risk management, ensures the collection of data from relevant stakeholders into a single system, streamlines risk management steps, and provides an overview of current risk trends and results. All these aspects ensure a structured approach to risk management, support informed decision-making, ensure compliance with applicable requirements, and enhance relationships with relevant stakeholders.

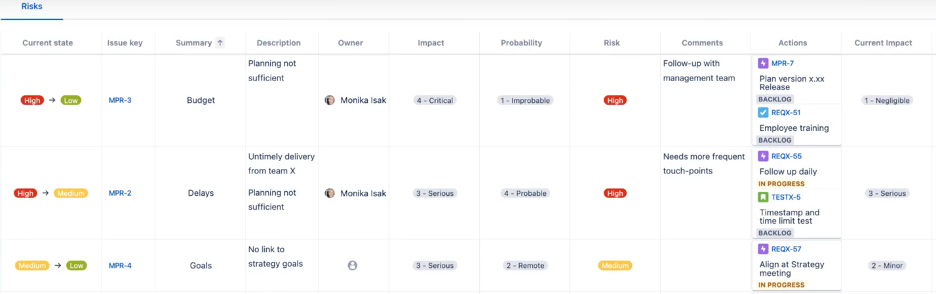

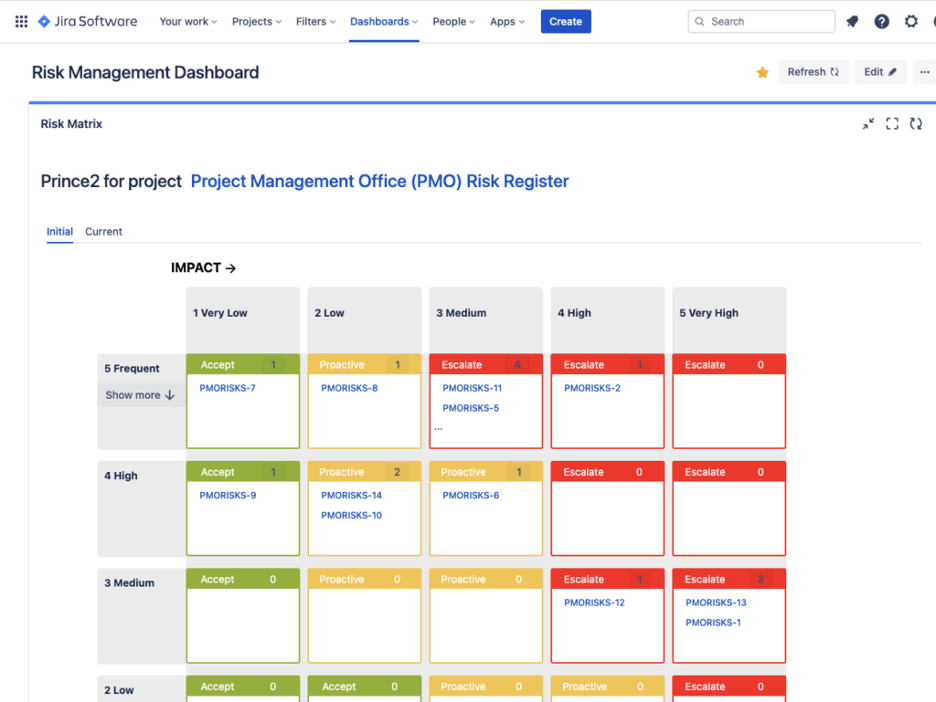

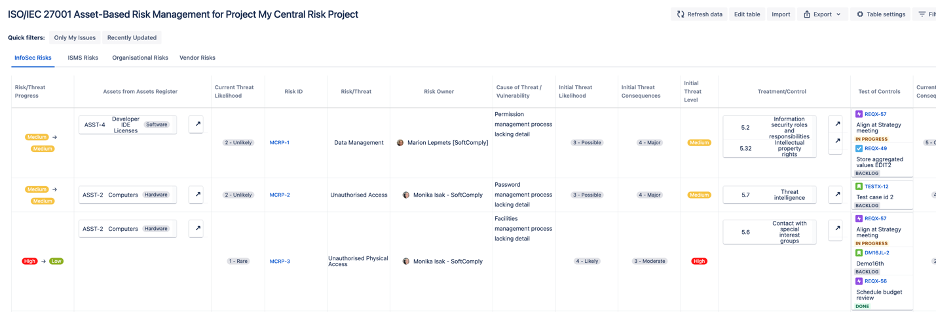

One example of such software is SoftComply Risk Manager Plus, which provides a structured and customizable risk management automation. After installing the application, you can create a risk management project, configure the project details, customize the risk model, and link mitigation and verification actions directly to risks. The collected risk data can be filtered, sorted, and exported for reporting and analysis purposes. By automating the risk management processes, SoftComply Risk Manager Plus ensures consistency, improves collaboration across stakeholders, and supports compliance with industry standards and regulatory requirements.

KEY CHALLENGES IN RISK MANAGEMENT

Implementing a risk management framework presents various challenges, including but not limited to:

1. Inconsistent Risk Management Process

Without a structured risk management process, different departments, teams, or projects approach risk management in an uncoordinated way. This lack of consistency can lead to critical risks going unnoticed or being underestimated, wasted resources from managing the same risk differently, poor decision-making, and noncompliance with applicable requirements.

A risk management software addresses this by providing standardized templates, workflows, and methodologies that ensure all teams follow the same structured approach.

2. Fragmented Visibility into Risk Data

Do stakeholders involved in risk management get the full picture? Yes, but only if they have a single risk ecosystem and shared visibility among departments. If not, even if each department is doing their part, the lack of shared visibility means no one can easily see how risks are connected or how serious they might be when combined. This can lead to slow responses and overlooked issues.

Risk management software solves this by centralizing all risk-related data into one integrated platform, allowing real-time access, visibility, and traceability across all departments.

3. Responding to Evolving Requirements

How are you embedding the evolving requirements in laws, regulations, and standards into your risk management process? As these requirements continue to change, updates should be reflected in your risk management processes to avoid overlooking new risks or continuing to rely on outdated measures.

A robust risk management software helps organizations stay compliant by allowing for easy updates to risk models, control libraries, and regulatory mappings.

ESSENTIAL FEATURES TO LOOK FOR

Choosing the right risk management software begins with identifying the features that best support your organization’s goals. Below are five essential features that every robust risk management solution should offer.

1. Risk Registers

A centralized risk register allows organizations to document, categorize, and monitor risks systematically. This centralization ensures that all stakeholders have access to consistent and up-to-date risk information, facilitating better decision-making and prioritization.

2. Automated Workflows

Automating risk management workflows streamlines processes such as risk assessments, approvals, and mitigation actions. This automation reduces manual errors, ensures consistency, and accelerates response times.

3. Integration with Existing Tools

Seamless integration with existing organizational tools (e.g., project management) ensures that risk management becomes an integral part of daily operations. This integration enhances user adoption and provides a holistic view of risks across various departments.4. Customizable Dashboards and Reports

Customizable dashboards provide real-time insights into risk status, trends, and mitigation effectiveness, enabling organizations to focus on specific metrics relevant to their objectives and regulatory requirements.

5. Compliance Support

TOP TOOLS FOR DIFFERENT USE CASES

There are numerous risk management tools available today, each designed to address specific targets based on an organization’s industry, size, risk appetite, regulatory landscape, and operational complexity. No single tool fits all scenarios. In this section, we will explore three of the top tools widely recognized for supporting risk management goals.

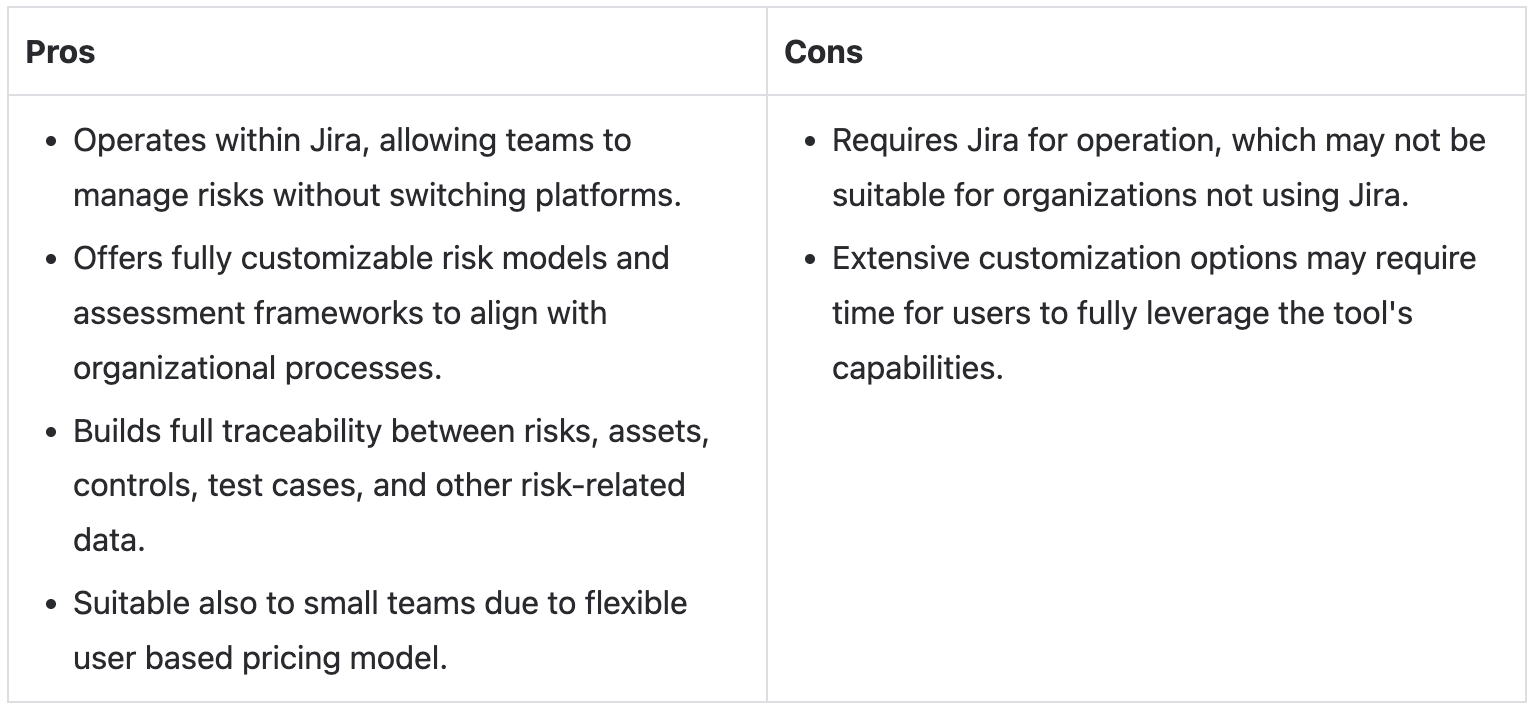

1. SoftComply Risk Manager Plus

SoftComply Risk Manager Plus is a Jira-based risk management tool suitable for enterprise risk management, information security, product safety, and project management. The tool supports compliance with standards such as ISO 14971, ISO/IEC 27001, the NIST Cybersecurity Framework, and FDA regulations.

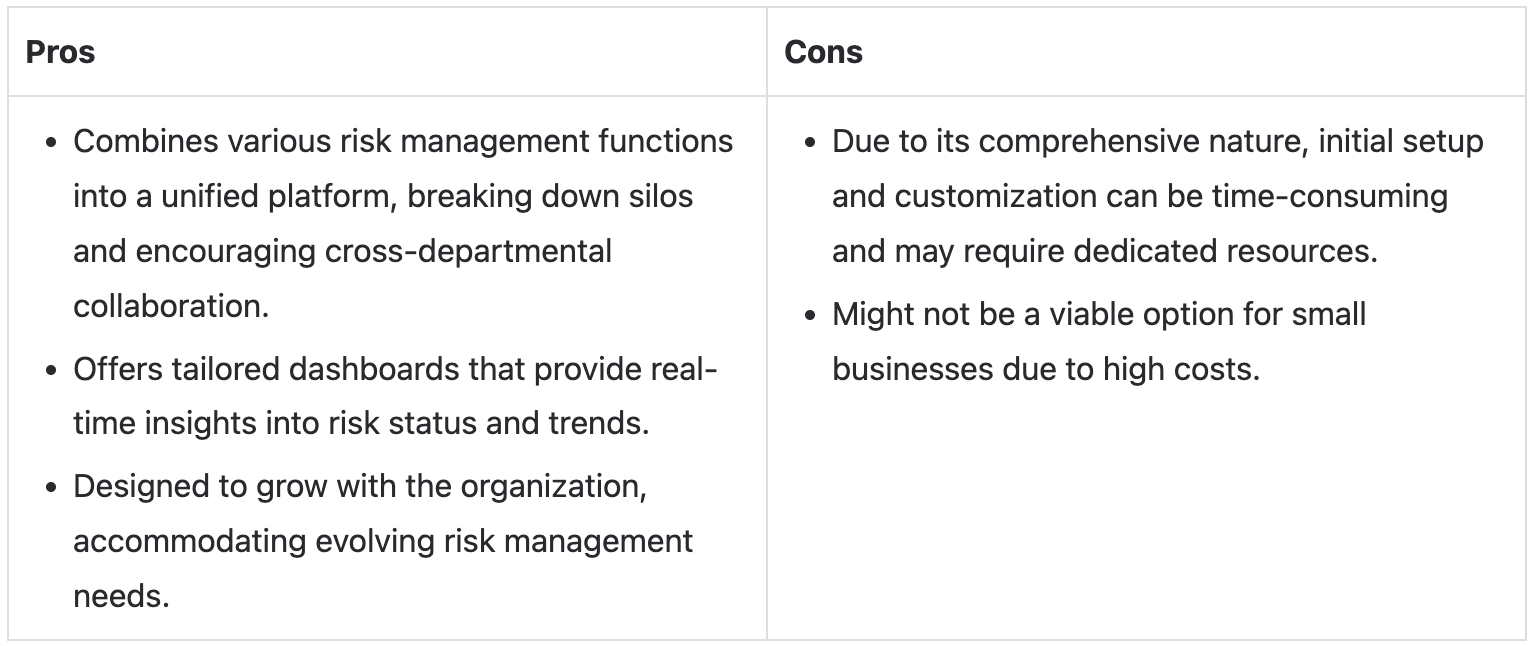

2. Riskonnect

Riskonnect offers a comprehensive view of risks across the enterprise, facilitating better decision-making by helping organizations understand interrelated risks and their cumulative impact. The tool assists organizations in adhering to various frameworks (e.g., NIST CSF, HIPAA, SOX) by providing features to document and manage compliance-related risks. In addition, it streamlines risk management processes, reduces redundancies, and promotes consistent practices across departments.

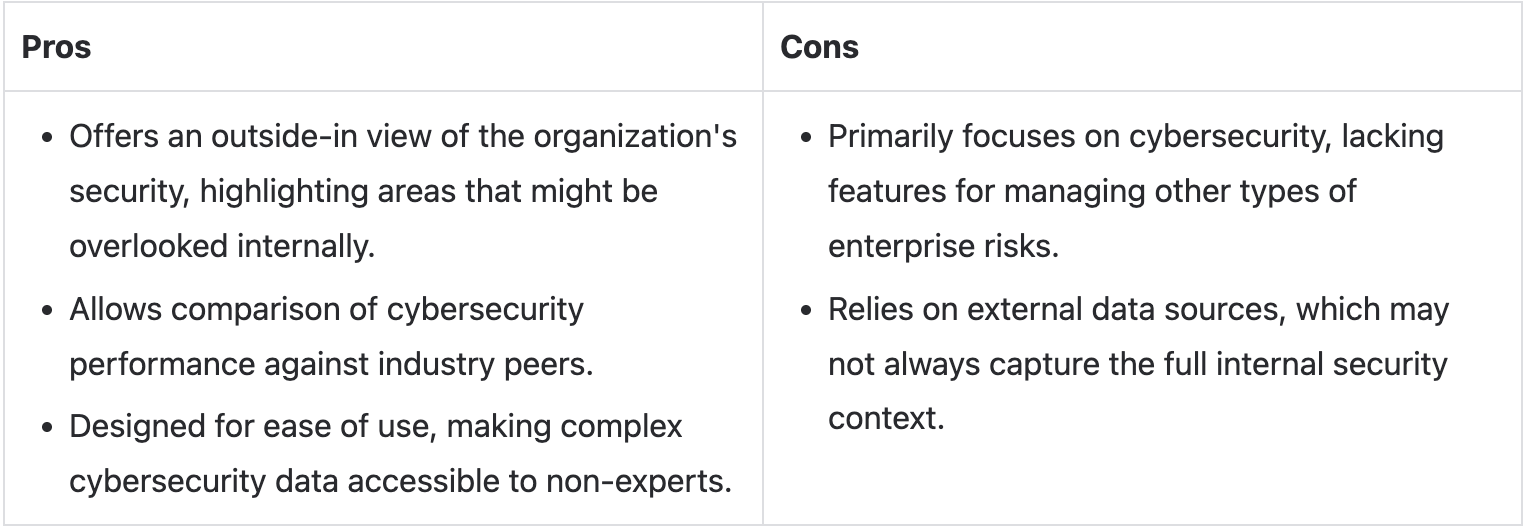

3. SecurityScorecard

SecurityScorecard provides ongoing assessments of an organization’s cybersecurity posture, identifying vulnerabilities in real time. The tool evaluates the security practices of vendors and partners, ensuring they meet the organization’s cybersecurity standards. It also assists in developing and refining response strategies for potential cyber incidents.

HOW TO CHOOSE THE RIGHT TOOL

Here’s a step-by-step guide to help you make an informed choice:

Step 1: Understand Your Organization’s Risk Management Needs

Start by identifying the specific reasons you’re seeking a risk management tool. This could be to meet regulatory obligations, improve risk visibility, or standardize risk processes across teams.

SoftComply Risk Manager Plus supports key frameworks such as ISO/IEC 27001, ISO 14971, NIST Cybersecurity Framework, FDA Cybersecurity Guidance, CVSS, and MDCG 2019-16, making it ideal for regulated industries.

Step 2: Set Requirements

Define your software requirements, including needed features (e.g., dashboards, automation, compliance tools), user access levels, and compatibility with existing systems.

SoftComply Risk Manager Plus offers customizable risk models, risk registers, automated workflows, Jira and Confluence integration, and compliance-ready reporting, addressing both technical and functional needs.

Step 3: Evaluate Vendors and Software Options

Develop your evaluation criteria by considering factors such as feature depth, ease of customization, vendor support, and pricing structure. Request demos to compare experiences across platforms.

SoftComply Risk Manager Plus offers tailored demos and documentation, enabling organizations to explore its Jira-native setup, regulatory templates, and ease of integration.

Step 4: Pilot Test

Run a limited trial or pilot to see how well the software works in practice with your team’s workflows and processes.

SoftComply Risk Manager Plus offers a free trial via the Atlassian Marketplace, allowing users to test features directly within their Jira instance.

Step 5: Compare and Score Options

Use a scoring matrix to evaluate options based on set criteria such as usability, integration, support, and compliance alignment.

Step 6: Plan for Implementation and Training

Evaluate the onboarding, training, and implementation support offered by each vendor to ensure a smooth transition.

SoftComply offers comprehensive user guides, training materials, and support, helping teams onboard quickly within their existing Jira environment.

ADDRESSING COMMON OBJECTIONS

During the software selection process, organizations often encounter concerns that can influence decision-making and affect the overall adoption timeline. Below are some of the most frequently raised objections:

1. Higher Costs

Organizations may hesitate to invest in software that appears expensive upfront, especially when the return on investment (ROI) isn’t immediately clear or when budget constraints are tight.

SoftComply Risk Manager Plus is available through Atlassian’s Marketplace with flexible subscription pricing based on user tiers, making it scalable for small teams and large enterprises alike.

2. Complex Implementation

Decision-makers often worry that implementing new software will disrupt current workflows, require significant time and resources, or demand extensive technical support.

SoftComply Risk Manager Plus is a native Jira application, allowing for a seamless setup with minimal disruption.

3. Resistance to Change

Employees may be reluctant to adopt new systems due to unfamiliarity, fear of learning curves, or satisfaction with existing tools, even if they’re less efficient.

SoftComply Risk Manager Plus minimizes change resistance by working directly within Jira, offering a user-friendly interface, familiar navigation, and comprehensive documentation that enable teams to adopt the tool easily without changing environments.

IMPLEMENTATION BEST PRACTICES

Implementing risk management software effectively requires a structured approach to ensure seamless integration and user adoption. Here are key best practices to consider:

1. Start with a Phased Rollout

What is a phased rollout? A phased rollout is an implementation strategy that allows organizations to introduce the new system gradually, minimizing disruptions and providing opportunities to address issues early.

2. Train Teams Effectively

Training is essential to equip users with the necessary competence to utilize the new tool efficiently, which leads to smother implementation, fewer errors and overall a higher return on investment.

3. Utilize Built-In Templates to Streamline Onboarding

Pre-configured templates can significantly speed up the onboarding process and ease the implementation burden by eliminating the need for users to create templates from scratch.

SoftComply Risk Manager Plus supports efficient onboarding by offering a range of ready-made templates, including FMEA, Hazard Analysis, and frameworks aligned with ISO 14971 and ISO 27001, all of which can be customized to fit specific organizational needs while maintaining compliance and best practices.

ROI OF RISK MANAGEMENT SOFTWARE

From what we have covered above, you now have a clear understanding that investing in risk management software is not just about one parameter, it is a strategic decision that can deliver measurable returns. These returns come from reducing manual processes, minimizing risks, and streamlining processes, all of which translate into significant cost savings and operational efficiencies.

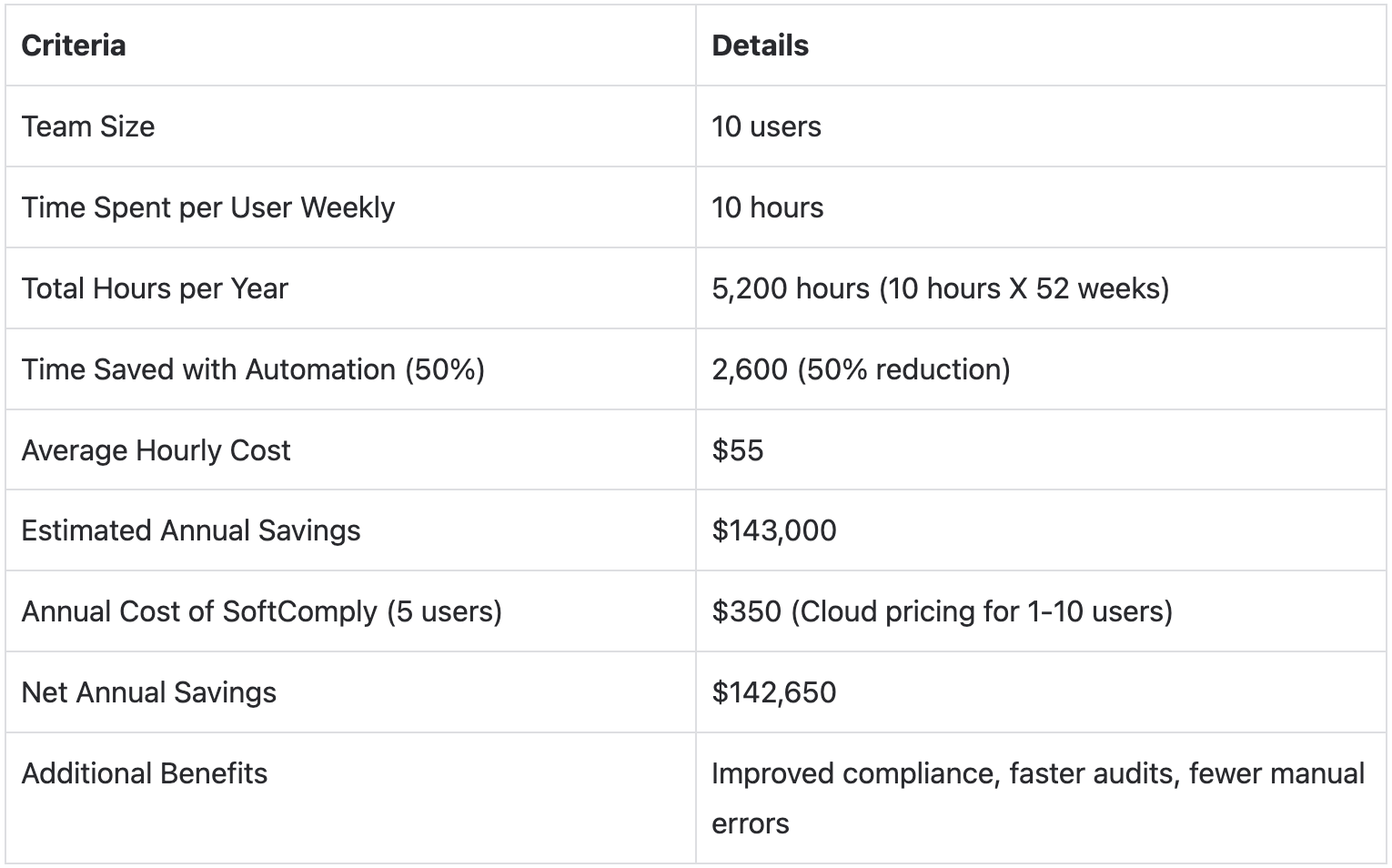

Let’s say an organization with a 10-person risk team currently manages risk tracking, reporting, and documentation manually. Each team member spends about 10 hours per week on these tasks, adding up to 5,200 hours annually.

By implementing SoftComply Risk Manager Plus, which offers automation and ready-to-use templates, organizations can significantly reduce the time spent on manual risk management tasks.

Note: Different industry sources suggest that automation and risk management software can reduce workload and related costs by anywhere from 30% to 80%, depending on the organization’s size, complexity, and current processes. For the sake of this example, we’ve used a conservative estimate of 50% time savings based on typical use cases.

The table below summarizes the estimated return on investment:

CONCLUSION

Choosing the right risk management software improves visibility, ensures compliance, and saves time. This guide showed how SoftComply Risk Manager Plus helps teams manage risks efficiently. It automates key tasks, supports industry standards, and integrates seamlessly with Jira. The tool is ideal for regulated industries that need a structured, reliable solution.

Book a call or try it for FREE to see how SoftComply Risk Manager Plus can support your organization’s risk management.